Achieving your dream to home ownership can sometimes feel like an insurmountable hurdle. But what if there was a way to bypass the traditional lending system and unlock alternative financing solutions? Enter private financing, a burgeoning sector/industry/market offering unique opportunities for homeowners seeking a flexible path to their dream property.

Private lenders, often individuals/companies/investors, provide funds directly to/for/with borrowers outside of the realm of banks and credit unions. This can be particularly beneficial/advantageous/attractive for those who may not qualify for/under/with conventional loans due to factors such as credit history/income levels/debt-to-income ratio.

The process of securing private financing often involves a more individualized approach, allowing borrowers and lenders to negotiate terms that best suit their specific needs. This can include flexible payment schedules/interest rate variations/unique loan structures tailored to the borrower's financial situation.

Before diving into private financing, it's crucial to thoroughly research/carefully consider/meticulously analyze different lenders and understand the terms/conditions/agreements involved. Seek expert advice/guidance/counsel from real estate professionals or financial advisors to navigate this process effectively.

Private financing can be a powerful tool/viable option/effective solution for unlocking your dream home, offering a path beyond conventional lending. With careful planning and due diligence, private financing can help you achieve your homeownership goals/property aspirations/real estate dreams.

Direct Private Lending: Effortless Mortgages

Seeking a rapid and adaptable mortgage solution? Direct private lending might be the ideal answer for you. Unlike traditional lenders, private lenders provide capital on their own terms, often with prompt approval times and less Non Bank Private Lender strict requirements. This approach allows borrowers to obtain funding even if they don't qualify with conventional lending options.

Private lenders emphasize building strong relationships with borrowers, concentrating on individual circumstances. This customized service can be particularly helpful for homebuyers with unique financial backgrounds.

- Benefits of Direct Private Lending:

- Rapid Approvals

- Flexible Terms

- Affordable Options

Embark the Private Mortgage Market with Confidence

Securing a mortgage in today's market can be a daunting endeavor. With fluctuating interest rates and rigorous lending criteria from traditional lenders, many borrowers find themselves investigating alternative options. This is where the private mortgage market comes in, offering a unique landscape of institutions willing to adapt their methods to meet the particular needs of borrowers.

To effectively traverse this market, homebuyers need to prepare themselves with a solid understanding of its dynamics.

Below are some key factors:

- Research various private lenders and contrast their terms.

- Understand the workflow involved, including documentation requirements.

- Cultivate a strong relationship with a reputable mortgage broker who specializes in the private market.

By following these recommendations, you can confidently explore on your journey through the private mortgage market and find the ideal financing option for your specific circumstances.

Refining Your Loan

Private mortgage refinancing presents a exceptional opportunity to lower your monthly payments and achieve greater financial flexibility. By securing a new mortgage with more favorable interest rates, you can materially reduce the aggregate cost of your loan.

Furthermore, refinancing allows you to alter the structure of your mortgage, such as the duration or payment. This flexibility can be crucial if your financial situation have evolved since you originally took out your mortgage.

Find Competitive Private Loan Solutions Now

Are you searching for alternative financing options that cater to your unique needs? Look no further! Our platform connects you with a diverse network of private lenders who offer favorable interest rates and flexible conditions. Whether you're planning a major purchase, need emergency funds, or simply want to consolidate liabilities, we have the perfect solution for you. Our streamlined application process makes it easy to get started and receive a decision within hours. Don't let financial challenges hold you back - explore the power of private loans today!

Navigating Your Trusted Source for Private Home Loans

When it matters to financing your dream home, private home loans can present a unique alternative. ,Yet, with so many institutions , on the market, out there, choosing the right one can be difficult. That's where we enter in. We are your reliable source for private home loans, committed to guiding you in the entire journey.

Our team of experts has extensive expertise in the private lending market, and we understand the individual expectations of our clients. We strive to offer a tailored experience that fulfills your objectives.

We attractive interest rates and manageable repayment terms, guaranteeing that your dream is a rewarding . experience. Contact us today to learn about how we can help you achieve your home ownership goals.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Monica Lewinsky Then & Now!

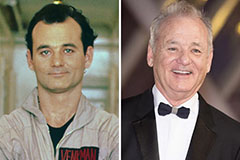

Monica Lewinsky Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!